Link Technologies - LinkSOFT Documentation

Link Technologies - LinkSOFT Documentation  Link Technologies - LinkSOFT Documentation

Link Technologies - LinkSOFT Documentation [564] | Purchasing | Maintenance |

Notes :

Report

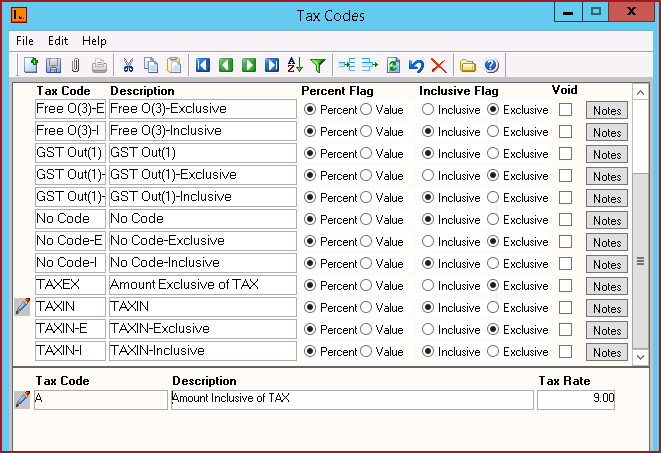

Table 1: Field Description for Tax Codes

| Fields | Description |

| Tax Code |

Enter the tax code.Tax Code should not contain special characters or spaces. |

| Description | Detailed description for the Tax Code. |

| Percent Flag |

If the tax is set as percentage then the tax will be calculated based on the set percentage. For Example, TAXIN price for an item is $5. The Tax Value is 12.5%. Therefore, the actual price of the item without tax will be $4.375, i.e. 5 - (5 * 12.5%) = 4.375 If the tax is set Value then immaterial of the price of the item, the tax will calculated based on the defined tax rate which is taken as the fixed amount to be calculated as the tax. E.g. TAXIN price for an item is $5. The defined tax rate is 2 then the actual price of the item without tax will be $3, i.e. 5 – 2 = 3 |

| Inclusive Flag | Specify if the tax setup is "Inclusive" or "Exclusive" of tax. |

| Void | Records that are "Void" will not appear in any

lookup on the system.

Users can click on the "Red X" under the menu icons to "Void" or "Activate" a record. |

| Notes | Users can enter any notes in the notes button. Notes button will be "BOLD" if it has contents. |

Detail

| Fields | Description |

| Tax Code |

Enter the "Tax Label" for the "Tax Code" |

| Description | Detailed description for the Tax Code. |

| Tax Rate | Tax is calculated according to the value entered in this field. |

Figure 1: Tax Code