| Subject: | ECAL and SRL calculations are invorrect when reducing ANHRS and adding other Gross Items |

| Summary: | When Gross Pay is changed, ECAL and SRL calculations are incorrect. In scenario 1 below, there are no changes and the tax calculations are correct. However in Scenario 2, when we reduce ANHRS to 24 and Add 16 hrs of AINC, SRL and ECAL are not calculated. See figure 2. This is not an issue when we replace AINC with AAL Scenario 1: Standard Process - All Calculations are correct - Employee EMP0001 is on a Salary Scale of $350,000

- The employee is on Standard Pay - Pay Frequency with 40 Hours per Pay

Figure 1 - Standard Process - All Calculations are correct

Scenario 2: Reduce ANHRS to 24 and Add 16 hrs of AINC. This is INCORRECT - Employee EMP0002 is on a Salary Scale of $350,000

- The employee is Paid 24 Hours as Normal Pay

- The employee is Paid 16 Hours as Incentive Payment (AINC) due to getting injury sustained at work and missing 2 Days

Figure 2 - SRL and ECAL is missing

Scenario 3 - Reduce ANHRS to 24 and Add 16 hrs of AAL - This is CORRECT Setup Details - Application Hosted on: https://linktechnologies.com.au/DEMO-LinkSOFT-EDGE

- Version: 13.40.0602

- Payrun No: 486

- Payrun Date: 07/01/2024

|

| Audit Notes: | Edited by sanjay on 06/07/22 13:57. Edited by sanjay on 22/06/22 16:04. |

| 22 Jun 2022 | 04:02PM Comment 1 by Sanjay (Link Technologies) Assigned To: Sanjay (Link Technologies) Followup Date: 22-06-2022 04:00 PM Time Taken: 6.00 |

| Meeting with Vineshwar and Sanjay: - Rewrite the case header to explain the issue clearly

- The issue is that the Tax Bracket is based on ANHRS, not on the Component type "Gross". This needs to be addressed as it is handled for AAL, but not other Components with type "Gross"

- Sanjay to investigate the issue further in Development

Transferring this case to DEVELOPMENT. |

|

| 22 Jun 2022 | 04:02PM Comment 2 by Sanjay (Link Technologies) Assigned To: Sanjay (Link Technologies) Followup Date: 22-06-2022 04:02 PM |

| REOPEN CASE for Transfer |

|

| 22 Jun 2022 | 04:04PM Comment 3 by Sanjay (Link Technologies) Case L12746 added to project 14.00 |

| 22 Jun 2022 | 06:09PM Comment 4 by Sanjay (Link Technologies) Assigned To: Sitla (Edge Business Solutions) Followup Date: 23-06-2022 12:05 AM Time Taken: 16.00 |

| PART A - Development work for this case has been completed. 1. The change will be available in versions: 14.00 and 13.40 PATCH 2. The following changes were made(Include Database object names, Program classes, and any other relevant information): - Changed Gross Pay Determination to base on the Component Type instead of Hours Paycode

3. Affected Areas: - Pay Calculations

4. The issue was caused by: - Design issue

5. Other Relevant Notes:

6. Next Step (Review and System Test (Developer) -> UAT (Quality) -> Documentation): UAT

UAT Notes: - Please test All Fiji and PNG Pay Calculations. I have applied the change to: https://www.linktechnologies.com.au/DEMO-LinkSOFT-EDGE

|

|

| 06 Jul 2022 | 01:57PM Comment 5 by Sanjay (Link Technologies) ETC was changed from 23/06/2022 to 23/06/2022 |

| 06 Jul 2022 | 01:59PM Comment 6 by Sanjay (Link Technologies) Assigned To: Development Followup Date: 06-07-2022 07:58 PM Time Taken: 1.00 |

| There has been no response from Edge in two weeks. Reassigning case for internal QA. |

|

| 19 Jul 2022 | 04:00PM Comment 7 by Sanjay (Link Technologies) Assigned To: Sanjay (Link Technologies) Followup Date: 19-07-2022 09:47 PM Time Taken: 6.00 |

|

The following tests were performed:

Table 1 - Test Results

| No | Test Case | Expected Result | Pass/Fail | Comments | | 1 | Create standard pay for an employee.

| Verify details are correct

| Pass

|

| | 2 | Reduce ANHRS (Gross Pay) item by 4 hrs

| Emoluments should be based on 4 hrs "Gross" less

| Pass

|

| | 3 | Add a new "Gross Pay" item

| Emoluments should be the same as 1. above

| Pass

|

| | 4 |

|

|

|

|

Environment Details - OS version: Win11

- Application version: 14.00

- Setup on:

- Server: LinkQA4

- Database: LinkSOFT

- LinkSOFT URL: HTTP://LinkQA4/LinkSOFT

- Login Details: Standard username and password for user "admin"

Next Step: Closure

|

|

| 28 Jul 2022 | 11:45AM Comment 8 by Vineshwar Prasad (Edge Business Solutions) Assigned To: Sanjay (Link Technologies) Followup Date: 28-07-2022 05:24 PM Time Taken: 1.00 Notes: ETC extended from: 23/06/2022 to 28/07/2022 |

| Meeting with Sanjay- The Calculations on Scenario 2 is Correct

- When Normal Hours is reduced, SRL & ECAL will not be calculated as the Standard Pay has reduced

- Normal Hours - 4038.46 x 52 Pay = 209,999.92. This is below the SRL & ECAL Tax Threshold

- PAYE is correct as Incentive Payment is treated under the Bonus column and thus included in Tax Calculation

- The Calculations on Scenario 3 is Correct

- When Normal Hours is reduced, Annual Leave makes up the Hours as the employee was on Leave

- We will need to reverse this change

|

|

| 28 Jul 2022 | 01:55PM Comment 9 by Sanjay (Link Technologies) Assigned To: Vineshwar Prasad (Edge Business Solutions) Followup Date: 28-07-2022 07:44 PM Time Taken: 5.00 |

| Hi Vineshwar, I have reversed this change. Patch for 13.40 is: LinkSOFT_13.40.0728.zip

Can you put your test results in this case and assign the case back to me? Please test this function thoroughly. |

|

| 29 Jul 2022 | 12:45PM Comment 10 by Vineshwar Prasad (Edge Business Solutions) Assigned To: Sanjay (Link Technologies) Followup Date: 29-07-2022 03:20 PM Time Taken: 4.00 Notes: Edited by vineshwar on 29/07/22 12:49. ETC extended from: 28/07/2022 to 29/07/2022 |

| Test Results

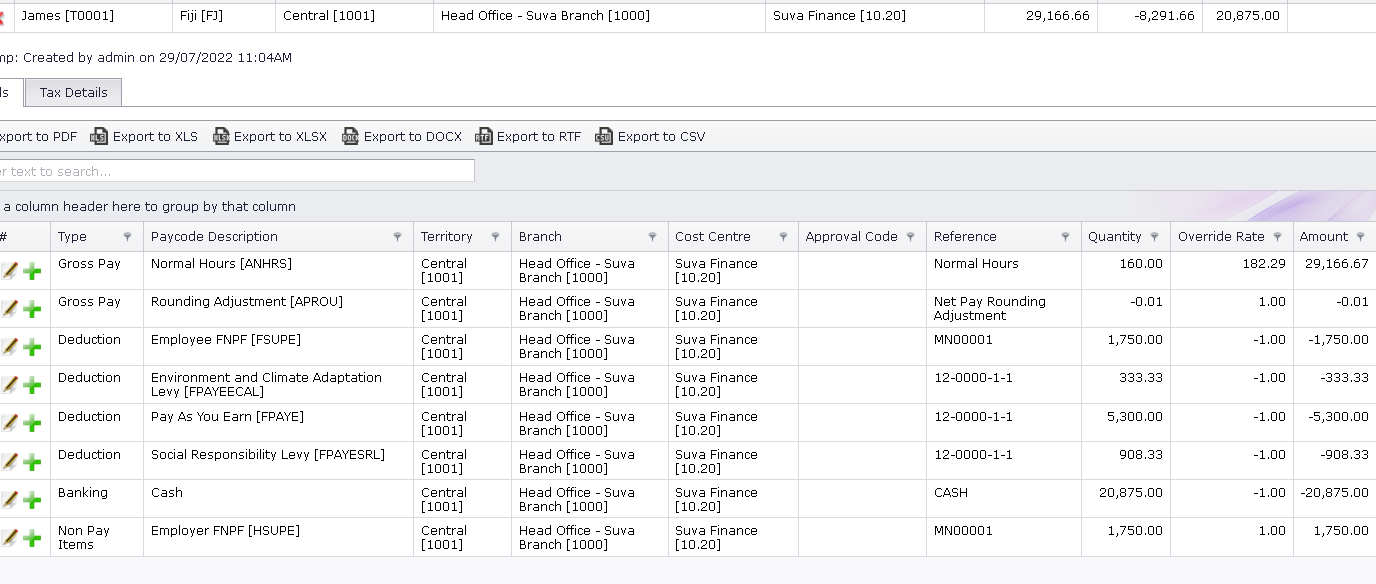

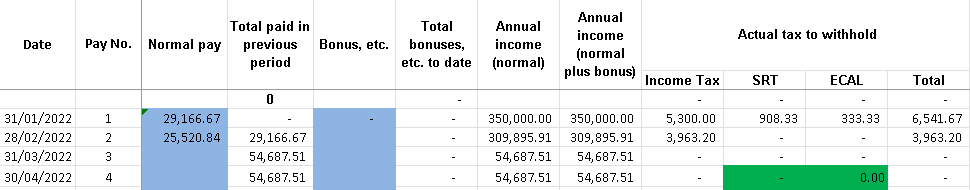

Scenario 1 - Standard Process (CORRECT)- Employee T0001 is on a Salary Scale of $350,000

- The employee is on Standard Pay - Pay Frequency with 160 Hours per Pay

- Pay is processed for February 2022 on a monthly basis

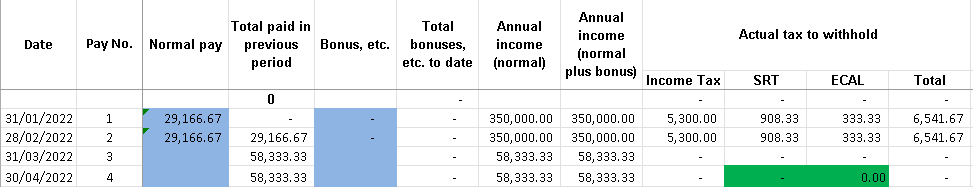

Figure 1 - Standard Process - All Calculations are Correct Figure 2 - FRCS Tax Calculation Sheet Scenario 2 - Standard Pay ANHRS 160 Hrs with Additional 5 Hrs Time & Half (CORRECT) Scenario 2 - Standard Pay ANHRS 160 Hrs with Additional 5 Hrs Time & Half (CORRECT)- Employee T0001 is on a Salary Scale of $350,000

- The employee is on Standard Pay - Pay Frequency with 160 Hours per Pay

- Pay is processed for February 2022 on a monthly basis

- The employee is Paid 160 Hrs as Normal Pay

- The employee is Paid 5 Hrs as Time & Half

Figure 3 - Normal Hours plus Time & Half Figure 4 - FRCS Tax Calculation Sheet Figure 4 - FRCS Tax Calculation Sheet

Note- All Calculations are correct

- Time & Half is treated as Additional from your Base Pay

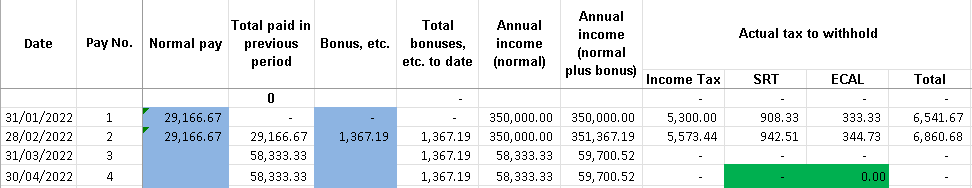

Scenario 3 - Normal Hours is reduced to 140 Hrs (CORRECT)- Employee T0001 is on a Salary Scale of $350,000

- The employee is on Standard Pay - Pay Frequency with 160 Hours per Pay

- Pay is processed for February 2022 on a monthly basis

- The employee is Paid 140 Hrs as Normal Pay

Figure 5 - Normal Hours reduced

Figure 6 - FRCS Tax Calculation Sheet

Note- All Calculations are correct

- SRL and ECAL are not calculated because the Base Pay is reduced. As a result, SRL and ECAL are making a recovery

Scenario 4 - Normal Hours is reduced to 140 Hrs with an Additional 5 Hrs Time & Half (CORRECT)- Employee T0001 is on a Salary Scale of $350,000

- The employee is on Standard Pay - Pay Frequency with 160 Hours per Pay

- Pay is processed for February 2022 on a monthly basis

- The employee is Paid 140 Hrs as Normal Pay

- The employee is Paid 10 Hrs as Time & Half

Figure 7 - Normal Hours reduced plus Time & Half

.PNG)

Figure 8 - FRCS Tax Calculation Sheet  Note Note- All Calculations are correct

- Time & Half is treated as Additional from your Base Pay

Environment Details- OS version: Win 10

- Application version: 13.40.0728.GA

- Setup on:

- Server: LINK-VINESHWAR

- Database: LinkSOFT

- LinkSOFT URL: HTTP://localhost/LinkSOFT

- Login Details: Standard username and password for user "admin"

Regards Vineshwar |

|

| 29 Jul 2022 | 01:52PM Comment 11 by Sanjay (Link Technologies) Assigned To: Sanjay (Link Technologies) Followup Date: 29-07-2022 07:51 PM |

| Thanks Vineshwar, closing case. |

|