Integration Setup menu maintains the integration configurations.

Integration Configuration and Setup Requirements.

-

Users need configure the below for ATO Single Touch:

-

Users need configure the below for FMS File Export: This will generate a flat file with data from LinkSOFT. The file can be imported by supported third party applications.

-

General Ledger Journal - Set the value as "Yes". Set the configuration for "EnableIntegrationScheduler" to "Yes" in the web config file.

-

-

Users need configure the below for FMIS DQL API :

-

"ServerName" - Leave the server name blank if the LINKSOFT and FMIS database are on the same server. System will directly connect to the database.

-

The server must be specified if the servers are on different machine. Users need to configure "Distributed Transactions Coordinator (DTC)"

-

-

DatabaseName" -This is the name of the FMIS database.

-

"Username" and "Password" - This is the login details for the server on which the database is hosted. Update the details if the LINKSOFT and External databases are hosted on different servers.

-

"OrganisationID" - This is only required for Epicor and Link Integration. Organisation ID is stored under "General Ledger --> Maintenance --> Setup --> Organisation Setup --> Organisation."

-

"CompanyCode" - This is only required for Epicor and Link Integration.Company Code is stored under "General Ledger --> Maintenance --> Setup --> Company Definition."

-

Set the value as "Yes" to enable integration for below components:

-

AccountsPayableMaster - Enable integration to Accounts Payable Master

-

AccountsPayablePurchaseGLGroup - Enable integration to Accounts Payable Purchase GL Group

-

AccountsPayablePurchaseOrder - Enable integration to Accounts Payable Purchase Order

-

AccountsReceivableAdjustment - Enable integration to Accounts Receivable Adjustment

-

AccountsReceivableMaster - Enable integration to Accounts Receivable Master

-

AccountsReceivablePaymentMethod - Enable integration to Accounts Receivable Payment Method

-

AccountsReceivableReceipt - Enable integration to Accounts Receivable Receipt

-

AccountsReceivableSalesOrder - Enable integration to Accounts Receivable Sales Order

-

AccountsReceivableTransaction - Enable integration to Accounts Receivable Transaction

-

BusinessIntelligenceReports - Enable integration to view data in reports

-

GeneralLedgerJournal - Enable integration to General Ledger Journals

-

GeneralLedgerMaster - Enable integration to General Ledger Master

-

Inventory - Enable integration to Inventory list.

-

MultiCurrencyMaster - Enable integration to foreign currency setup and conversions.

-

TaxMaster - Enable integration to tax labels and rates.

-

-

-

Users need configure the below for FRCSSDC . (Only applicable for VAT Monitoring Setups in Fiji). An email alert will be sent if there is a failure in FRCS Integration. The email will be sent to the email address configured in "LinkWeb - Company Administration - Document Template - FRCS Web API Alert".

-

MinimumProductQuantity - This value is defaulted to 0.001. Change according to FRCS requirements.

-

AllowedTaxLabel - This value is defaulted to A,B,E,F,N,P

-

TaxIntegration_ESDC_Enabled - Set the value to "Yes". Users need to configure below rules:

-

Tax Integration (ESDC) API URL - Enter the "API URL" for ESDC. For Example, http://192.168.0.107:8180 . "192.168.0.107" is the IP of the machine on which SoftESDC is installed or the IP of the Inspur of the device. "8180" is standard.

-

Tax Integration (ESDC) Secure Card PIN - Enter the "PIN"number of the smart card.

-

Tax Integration (ESDC) Batch Size - This is number of transactions per batch to integrate into LinkSOFT. This is defaulted to 100.

-

CashierTaxFileNumber - Enter the "Tax Identification Number" of the user who posts invoices.

-

-

-

Users need configure the below for Helpdesk EmaiL Import :

-

Email Server - Enter the address of the mail server.

-

Email Port - Enter the email port number.

-

Emal Use SSL - Set the value as "Yes" is SSL is required.

-

Email Username and Password - Enter the credentials to authenicate the email setup.

-

"New Call" Template - Create a template under "New Case Template ". This template will used to created the cases from Email.

-

-

Users need to configure the below for "PAYDirectBankFile","PAYSuperFile " and "PAYTaxFile ".

-

Email Address - Enter the email to which the file should be sent. Users can enter multiple addresses separated by a semicolon.

-

Email Body - Enter body of the email.

-

File Extension - Enter the file extension for the electronic files.

-

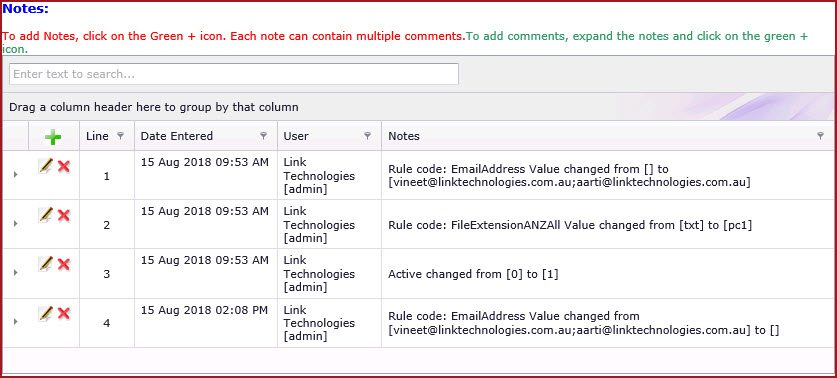

Steps to Configure Refer to Figure 1.

-

Click on the "Grey Triangle" next to the code to expand into the details.

-

Click on the "Pencil Icon" to edit details.

-

Enter the details and "Save" record.

-

Edit the Module as mark it as "Active"

-

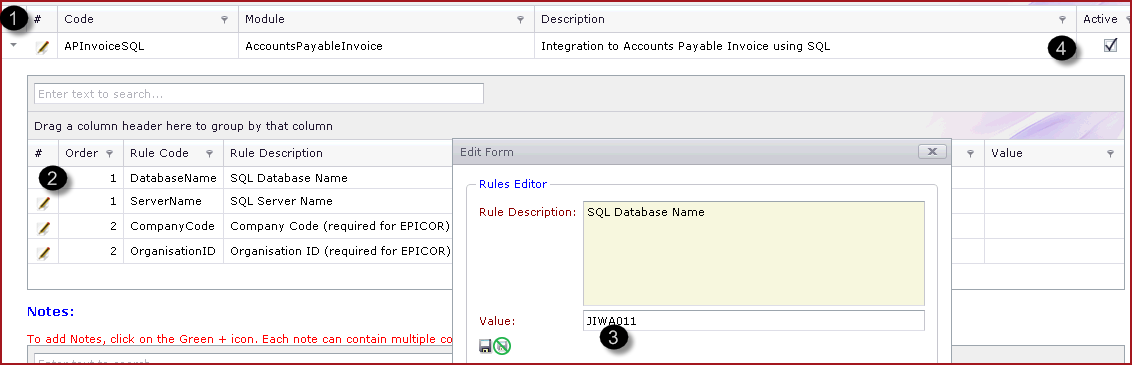

"Notes" section will record configuration values that are changed. Refer to Figure 2.

Figure 1 : Integration Setup

Figure 2

:

Integration

Notes