[311-1] | Payroll | Maintenance Setup | Setup Codes|

It is recommended that all pay codes be prefixed with

the "Classification" for payroll processing.

For example, if the user is creating "Normal Hours" pay code,

the code should have A as

the prefix before entering user defined code: ANHRS. This indicates that "Normal Hours"

is part of the "Gross

Pay".

The codes are classified as below:

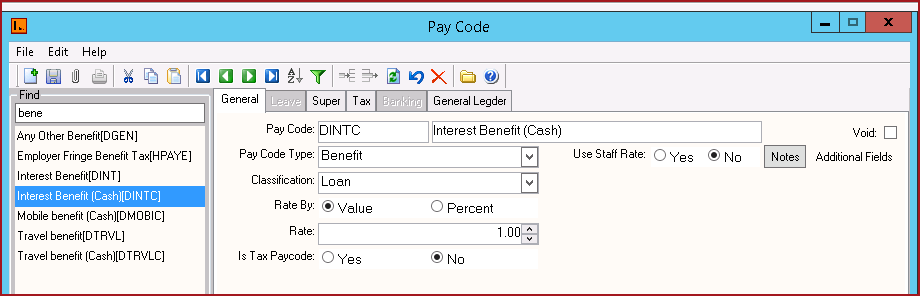

Users can search for pay codes on the Pay Code screen by searching for the Pay Code or description under "Find" on the search panel.Refer to Figure 1.

Figure 1: Pay Code

The General Tab on the pay code screen contains the following types of information . The general tab is enabled for all pay codes.

|

Fields |

Description |

|

Pay Code |

This will have a prefix of one of the "Classification"

defined and then the user defined code. The user defined codes can be

numeric, alpha, or alphanumeric. |

|

Description |

Detailed description for the Pay Code. |

| Pay Code Type | Pay Code Type classifies the paycode. For example, Gross Paycode, Benefit Paycode etc.Select the classification from the drop down. |

|

Classification

|

Classification is used to categorize benefit pay codes. This is used to compute the tax amount for tax submission. Classifications are maintained under "PayClassification" in LinkWeb. |

|

Use Staff Rate

|

The rate used is derived from the rate specified

in the employee record, Pay Rate in Use field.

Yes – to use staff rate. This will normally be used

for allowances.

No – to enter a fixed value for the pay code created

instead of using the staff rate.

|

|

Rate By

|

The user can select whether to calculate rate by value

or percentage. |

|

Rate

|

Enter Rate if an amount is fixed for the pay code and

applicable to all employees during pay processing. If the value is not

known until the time of transaction entry, leave this field blank. By

default it should be 1.

|

| Is Tax Paycode |

Paycodes that have "Is Tax Paycode" enabled will be used in the summation of the tax amount on reports. By default the following Paycodes have this enabled:

|

|

Addnl |

These are the User defined Fields. |

The Leave Tab on the pay code screen contains the following types of information . The leave tab is enabled for pay codes with classification as Gross.

Fields |

Description |

|

Calculate Leave |

If Calculate Leave is "Yes" then the hours for the pay code will be used for calculation of leave accrual. This is applicable for proportional leave accrual method. |

The Super Tab on the pay code screen contains the following types of information. The Super tab is enabled for pay codes with classification as Gross, Taxable Allowance, Benefit and Non Taxable Allowance.

Fields |

Description |

|

Includes SUPER |

If Include Super is "Yes" then superannuation will be calculated for the pay code. |

The Tax Tab on the pay code screen contains the following types of information. The Tax tab is enabled for pay codes with classification as Benefit.

Fields |

Description |

|

Benefit Type |

Users can select the benefit type which can be either Cash (Cash Benefit) or Tax Only (Fringe Benefit). |

|

Tax Scale |

Select the appropriate tax scale from the list. This option is only enabled for Benefit type pay codes. When a tax scale is selected for a pay code, the tax is calculated based on the tax scale for any amounts against this pay code. The standard tax calculation will exclude pay codes that have a tax scale selected. Users need to select the Tax Scale as "FJFBT" for benefit type "Tax Only". |

The Banking Tab on the pay code screen contains the following types of information. The Banking tab is enabled for pay codes with classification as Deduction and Banking.

Fields |

Description |

|

Includes Bank DCR |

LinkPAY can direct credit any allowance or deduction.

Select either Yes or No:

|

| Bank Code | If Yes is selected it Includes Bank DCR field, this field is enabled to enter the bank code. This is the bank code that will appear on the account of the direct credit account holder. |

|

Bank Account |

Enter the bank account number for deductions to be sent with electronic bank file. |

The General Ledger Tab on the pay code screen contains the following types of information. The General Ledger tab is enabled for all pay codes.

Fields |

Description |

|

GL Account Code |

This is the General Ledger code that is used when details about a pay code are exported to your General Ledger software. Depending on the pay code, It is either the credit or debit side of the transaction. |

| Creditor Code | This is the alternate pay code that can be entered for integration into other systems. |

|

Commission % |

Commission % is the commission amount in percentage for insurance payments |

| Commission GL Code | This is the general ledger code for the commission account. |

| Group GL Transactions | When Group GL transaction is set as YES then it will group all the like transactions as per the GL codes. |

Table 6: General Ledger Tab on Pay Code Screen

Steps

1.

Select the Add New Record

icon or press CTRL+N and a new record will be created to fill

in the Pay code details.

2.

Create Pay Codes as

required.

3.

After entering the

record(s), click on the SAVE icon or press CRTL + S to save the

record(s) successfully.

4. Select close icon or press Alt + F4 to

close the menu.

See Also Standard List of Pay Codes