Link Technologies - LinkSOFT Documentation

Link Technologies - LinkSOFT Documentation  Link Technologies - LinkSOFT Documentation

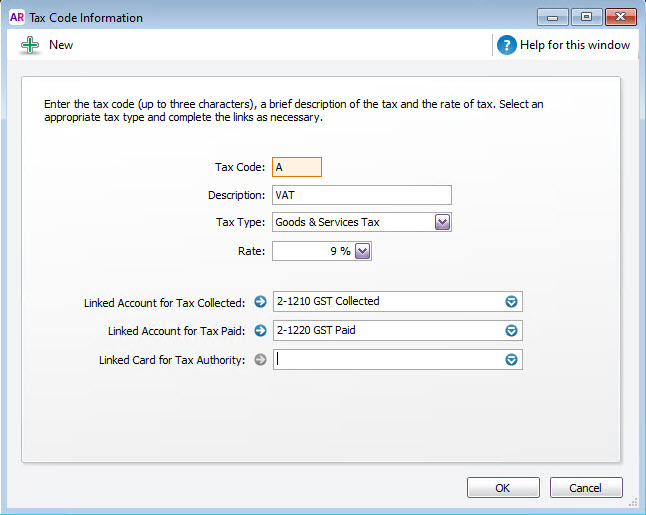

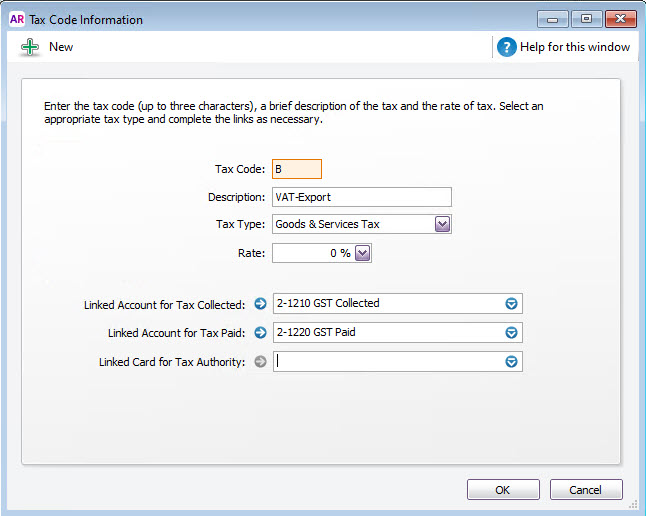

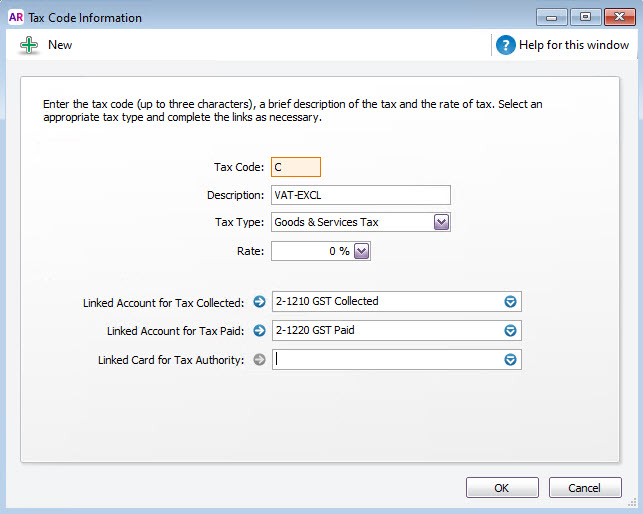

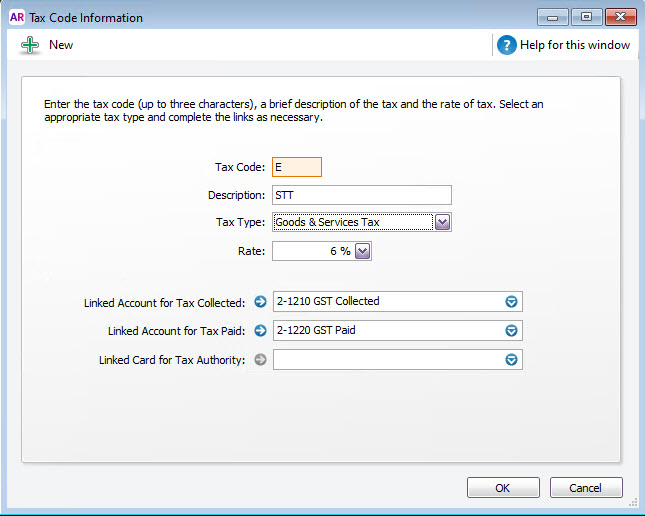

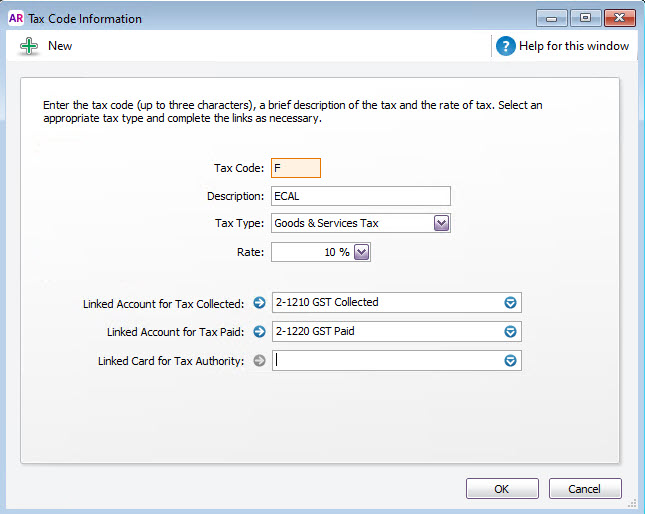

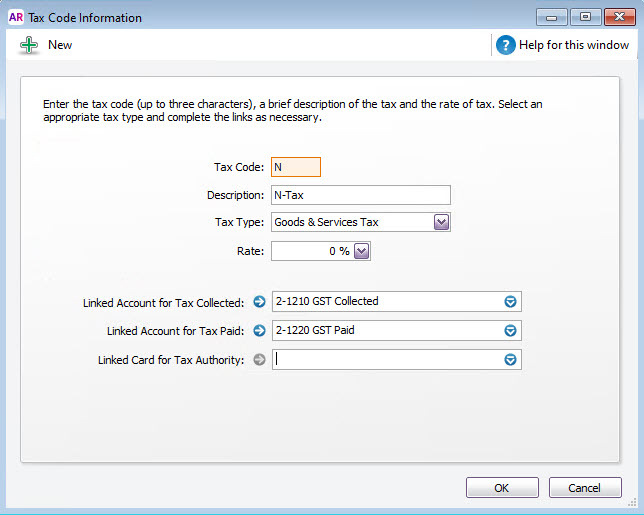

Link Technologies - LinkSOFT Documentation Use the below as an example on how to setup different tax codes in MYOB. Your tax authority rates may be different.

| Name | Abbr | Tax Label | Rate/Amount | Setup in MYOB AccountRight |

| Value Added Tax | VAT | A | 9.00% |  |

| Value Added Tax Export | VAT-EXPORT | B | 0.00% |  |

| Value Added Tax Excluded | VAT-EXCL | C | 0.00% |  |

| Service Turnover Tax | STT | E | 6.00% |  |

| Environment Climate Adaption Levy | ECAL | F | 10.00% |  |

| Plastic Bag Levy | PBL | P | 0.20 FJD | Direct tax is not supported in MYOB. |

| Non-Tax | N-Tax | N | 0.00 |  |

|

Combined Taxes:

|

VAT + STT + ECAL | AEF | 25.00% |

To set up multiple tax rates in MYOB, follow these steps:

|