Link Technologies - LinkSOFT Documentation

Link Technologies - LinkSOFT Documentation  Link Technologies - LinkSOFT Documentation

Link Technologies - LinkSOFT Documentation

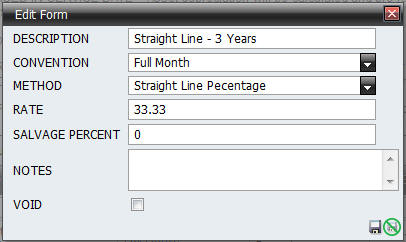

Maintain Depreciation Rules contains the following types of information:

| Fields | Description |

| Description | Enter a description for the Depreciation Rule. |

| Convention |

Conventions are defined

as follows: FULL MONTH - Assets will be depreciated for the Full Month. PLACED IN SERVICE DATE - Asset depreciation will be calculated and pro-rated for the month based on the ACQUISITION DATE . (Available for Enterprise Edition of Asset Management ). |

| Method |

The Method used to

calculate depreciation for the asset. The Depreciation METHOD can be defined as follows: STRAIGHT LINE - Depreciation is calculated based on the Initial Value and spread over the life of the asset. The value will be consistent over the life of the asset. DECLINING BALANCE - The Declining Balance Method provides for greater depreciation expense at the beginning of an Asset's life. The depreciation expense then declines each period of the asset's life. Since declining balance depreciation is based on a percentage of the asset's basis, the basis will not reduce to zero. NONE - If the company is set to calculate depreciation, any one asset may be set to not have depreciation calculated. This allows for the entering and tracking of non-depreciable assets such as land. |

| Rate | Rate of the depreciation. |

| Salvage Percent | The estimated value of the asset at the end of its useful life. This value is reduced from the INITIAL COST before depreciation is calculated. |

| Notes | Enter details on the depreciation rule. |

| Void | You may Void a depreciation rule. |