Click on the "Add New Icon"  . An entry line will appear on the screen.

. An entry line will appear on the screen.

-

A new line will be added on the selected record.

-

If the new "Tax ID" created differs from the selected" Tax ID" than the system will create a new record or else an additional entry will be created for the existing "Tax ID".

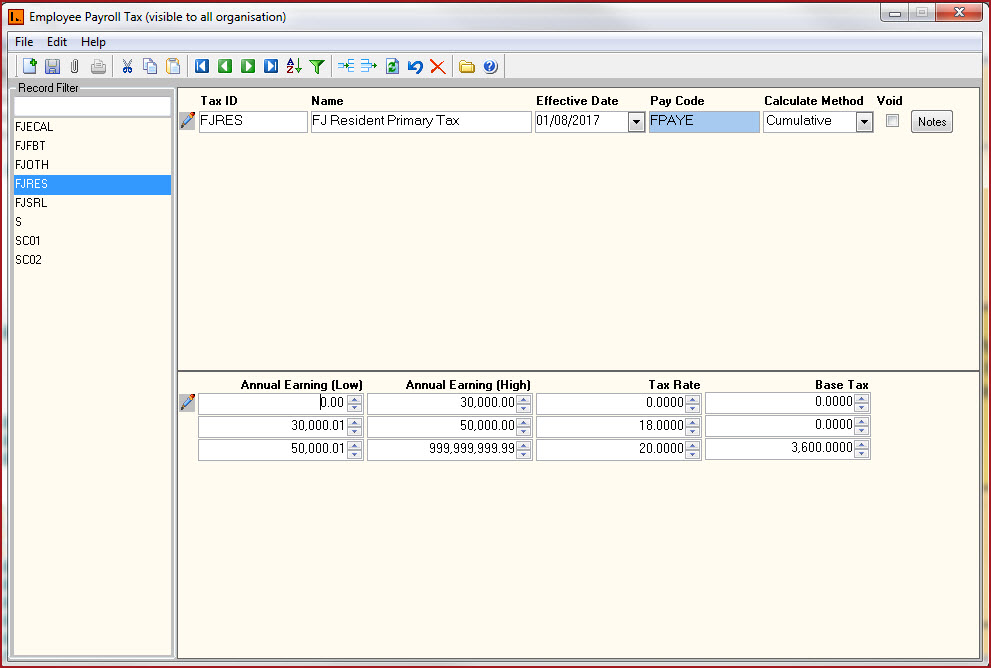

Enter the TAX ID. This is

an unique code to identify the Tax Type.

Enter the description of the Tax

Enter the Effective Date for the Tax.

Select the Pay Code ,

this lists paycodes that have "Is Tax Paycode" enabled. Tax calculated will

be reflected in the pay with the defined paycode.

Select the Calculate Method.

-

Straight Line - Fixed Tax will be deducted based on the income and tax rate.

-

Cumulative - Tax will deducted on a cumulative basis with respect to the Gross Amount at each pay.

Records that are "Void" will not appear in any

lookup on the system.Users can click on the "Red X" under the menu

icons to "Void" or "Activate" a record.

Users can enter any notes in the

notes button. Notes button will be "BOLD" if it has

contents.

To add the details of the Tax, click on the

"Insert Icon"  . An entry line will appear on

the screen.

. An entry line will appear on

the screen.

Enter the

Tax Bracket Details. The heading for the brackets can be configured underPayroll

~> Tax Configuration in

Link Web.

-

Low Salary and High Salary - Low and High Salary defines the Income range which is taxable.

-

Tax Rate - This is the tax rate in percentage.

-

Base Tax - Base Tax is provided by the Tax Company.