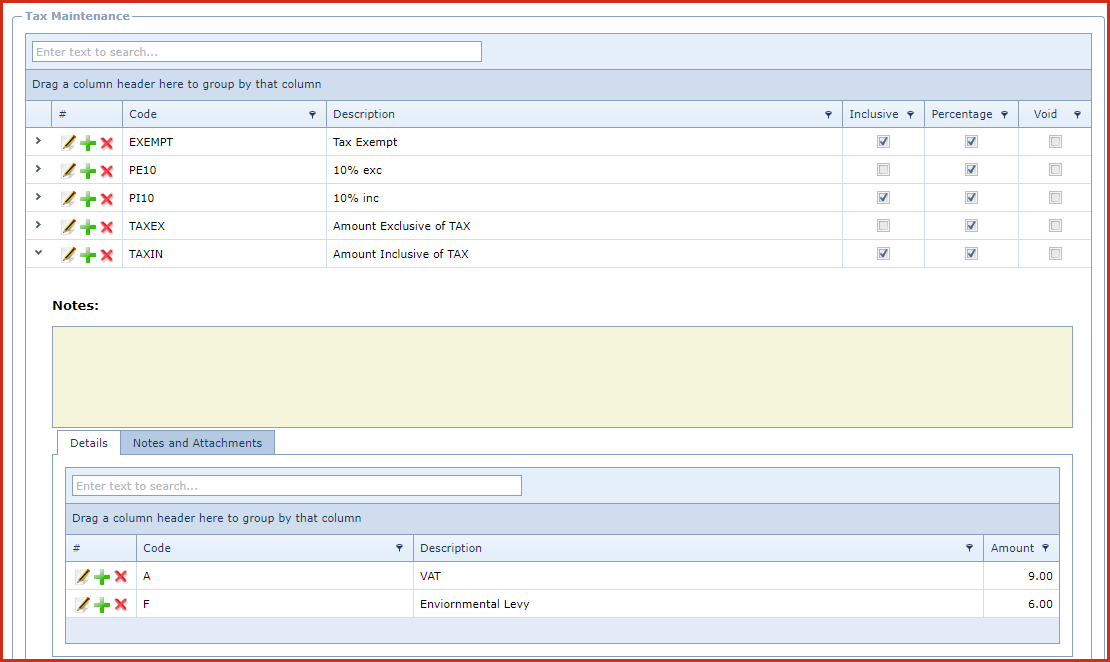

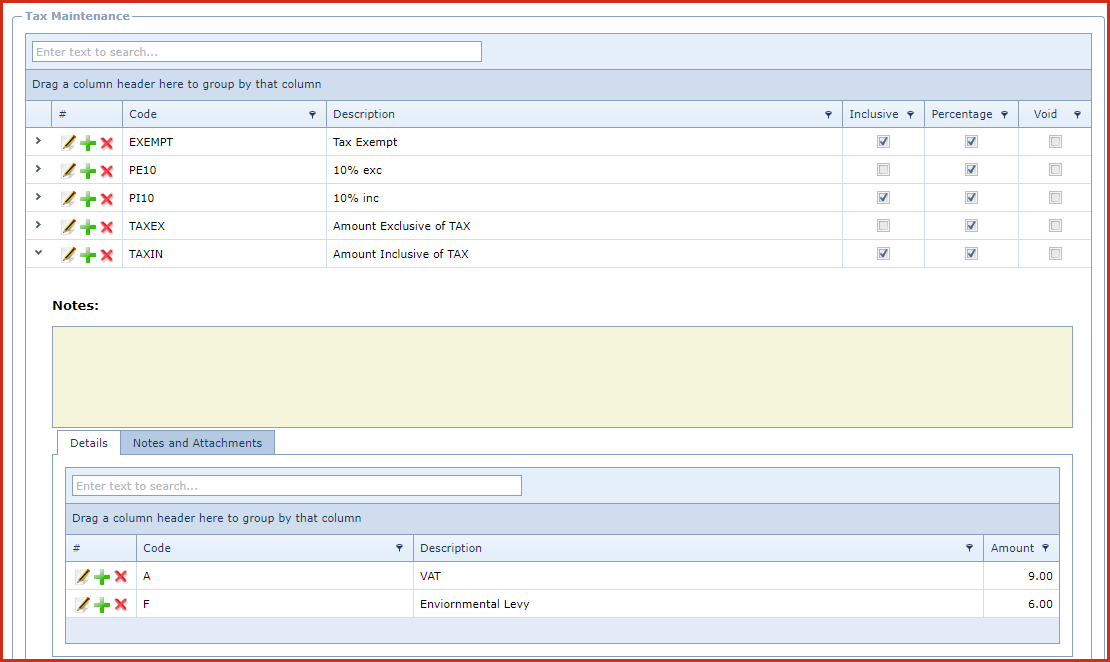

Tax

Maintenance is used to create and

maintain the buying and selling tax rates. The menu stores the tax codes,

tax labels and tax rate by value or percentage.

"Tax Code" defines the type of tax and the "Tax Label" are used to list

tax components. For example, service provides pay 16% tax which is a sum of

VAT (10%) and Environment Levy (6%), tax labels are then use to differentiate

each tax and their rates.

Reports

-

Tax Code Listing

Report

Steps to setup Tax

Rates:

-

Click on the "Green Plus Sign". This will open the "Edit

Form".

-

Enter below details

-

Code - Enter a code which can be a set of alphanumeric values

to uniquely identify each Tax setup.

-

Description - Enter the detailed description of the

tax.

-

Inclusive - Tick the "Check Box"to indicate that

the tax is inclusive where the price will include VAT. If this is not

ticked that the tax is considered to be exclusive and the price is

expressed without VAT.

-

Percentage - Tick the "Check Box" if the

tax rate is a percentage.

Price

and tax component will be calculated based on the set percentage. For Example, TAXIN

price for an item is $5. The tax rate is

9%.

-

If the box is

unticked then the tax will calculated based on the defined tax value which is

taken as the fixed amount to be calculated as the tax. E.g. TAXIN price

for an item is $5. The defined tax rate is 2 then the actual price of the

item without tax will be $3, i.e. 5 – 2 = 3

-

Notes - This is an open text field, users can

enter desired content.

-

Void - Void records

will be "Disabled" and will not appear in any lookups . Edit the record and

"UN-tick" void to activate a record.

-

Save. Click on the "Floppy Icon".

-

Click on the "Grey Arrow" to expand into details:

-

Click on the "Green Plus Sign". This will open the

"Edit Form".

-

Enter below details

-

Code - Enter a code which can be a set of

alphanumeric values to uniquely identify each Tax label.

-

Description - Enter the detailed description of the tax.

-

Amount - Enter the tax rate or value.

-

Save. Click on the "Floppy Icon".

Figure 1: Tax Maintenance

Link Technologies - LinkSOFT Documentation

Link Technologies - LinkSOFT Documentation  Link Technologies - LinkSOFT Documentation

Link Technologies - LinkSOFT Documentation