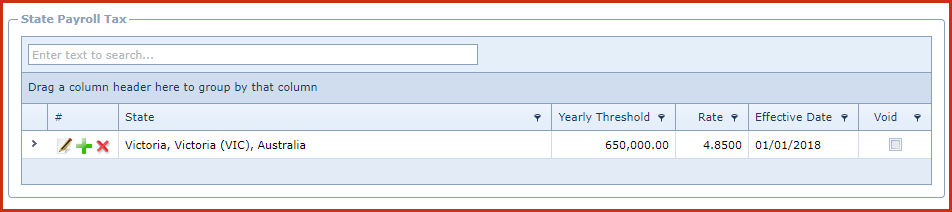

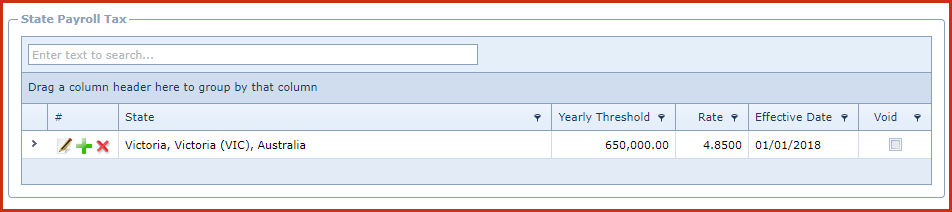

State Payroll

Tax is used to create and maintained tax setups for a specific state in a

country.

Pre-requisites

-

Enable the "Allow Add", "Allow Edit" and "Allow Delete"

access under "

Role

Menu Access " to make changes.

Steps to create a Service

Type:

-

Click on "Green Plus Sign". This will open the edit

form.

-

Enter below details:

-

State - Select the state. State is maintained under

"Linkweb - Company Administration - "Dropdowns -

State"

-

Yearly Threshold - Enter the gross threshold. If

the Total Gross Salary is in excess of the threshold amount, the

company will be paying the excess multiplied by the rate as employer

payroll tax

-

Rate - Enter the tax rate.

-

Effective Date - Enter the date from which the rate is effective.

-

Notes - This is an open text field, users can enter

desired content.

-

Void - Void records will be "Disabled" and will not

appear in any lookups . Edit the record and "UN-tick" void to activate a

record

-

Save. Click on the "Floppy Icon".

Figure 1: State Payroll Tax

Link Technologies - LinkSOFT Documentation

Link Technologies - LinkSOFT Documentation  Link Technologies - LinkSOFT Documentation

Link Technologies - LinkSOFT Documentation