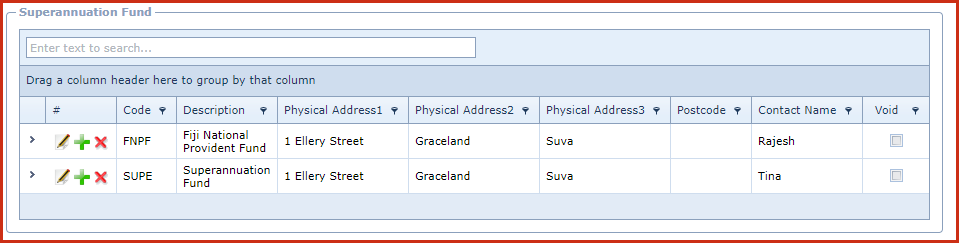

Code - Enter a code which can be a

set of alphanumeric values to uniquely identify each fund

company.

Description - Enter the detailed name of

the fund company.

Reference - Enter the reference

number provided by the fund

Physical Addresses 1 to 3 - Enter the

physical location of the fund company.

City - Select the city.

City is maintained under "Linkweb - Company Administration - Dropdowns -

City".

Post Code - Enter the

postcode or zip code for the fund company.

Postal Addresses 1 to

3 - Enter the postal address of the fund company.

Phone - Enter the

phone number of the fund company.

Fax - Enter the fax

number of the fund company.

Email - Enter

the email address of the fund company.

Contact Name -

Enter the name of the contact person.

-

Notes - This is an open text field, users

can enter desired content.

-

Default - Funds marked as default will be

automatically added when a new employee is

created.

-

Void - Void records will be "Disabled" and

will not appear in any lookups . Edit the record and "un-tick" void to

activate a record

Link Technologies - LinkSOFT Documentation

Link Technologies - LinkSOFT Documentation  Link Technologies - LinkSOFT Documentation

Link Technologies - LinkSOFT Documentation