Pay Processing allows users to create and

manage all pays for a organisation.

Notes

-

Set

the access for "Pay

Processing" as "Active" under "

Role

Menu Access

" to allow users to view records.

-

Set the access for "Pay

Processing- Verify Pay" and "Pay Processing- Create Pay" as "Active" to allow users to verify and

update pay.

-

Enable "Allow Add",

"Allow Edit" and "Allow Delete" access for a user to make

changes.

Enable process "SYS001" under "Linkweb - Company

Administration - Processes".

Prerequisites for Pay Processing:

Create the standard pay for all

employees.

Steps to create a

Pay:

-

Click on the

"Green Plus" sign to add a record. This will open the "Edit Form".

-

Enter below

details

-

Type - Select the pay type from

the list.

-

Configure the rules for each pay

type under Payrun

Type Configuration before creating a pay. Only the

configured values will populate in the pay.

-

Team - Select the pay team to create the pay for a specific "Pay

Team". This will create the pay for all employees in the selected "Pay

Team".

-

Employee - Users can select to create

the pay for a

specific "Employee".

-

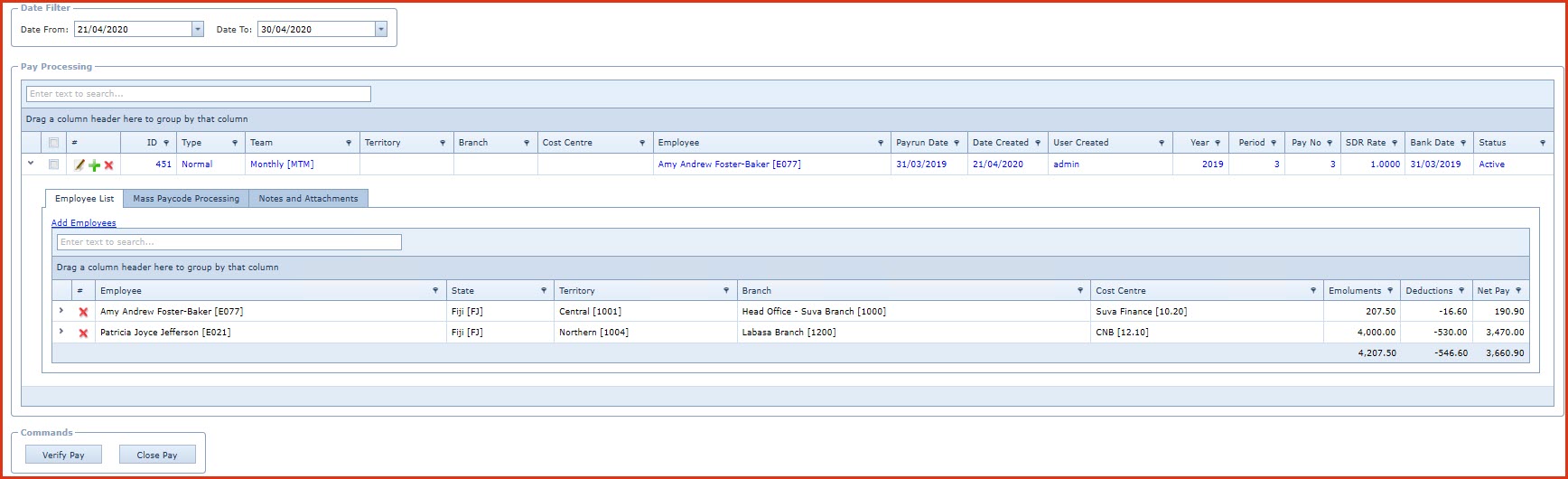

Users can

add employees to the pay through the "Add Employees"

option under "Employee List". Refer to Figure

1.

-

To create the pay for all employees do not

filter the "Territory", "Branch", "Cost Centre" or

"Employee".

-

Territory - Users can select to create

the pay for a specific "Territory". This will create the pay for all

employees in the

selected "Territory".

-

Branch - Users can select to create

the pay for a specific "Branch". This will create the pay for all

employees in the

selected "Branch".

-

Cost Centre - Users can select to

create the pay for a specific "Cost Centre". This will create the pay for

all employees in the

selected "Cost Centre".

-

SDR Rate - Enter the "Special Drawing Right" rate

for the pay. This is

applicable

for specific

countries like Australia.

-

Bank Date - Enter the "Banking Date"

for the pay.

-

Save. Click

the "Floppy Icon".

-

The initial status of the record

will

be "Queued". Background process "SYS001" will compute

the pay values.

-

The status will be updated to

"Active"

once the pay has been created. Refer

to Figure 1.

-

Edit Pay -

Users will be able to only edit "Active" pays. Note: Bank Components and entries that have been imported

(contains an Import Reference) cannot be edited.

-

Click on the "Grey

Arrow" to expand into the details

of

the pay. This will list the employees

in the pay.

-

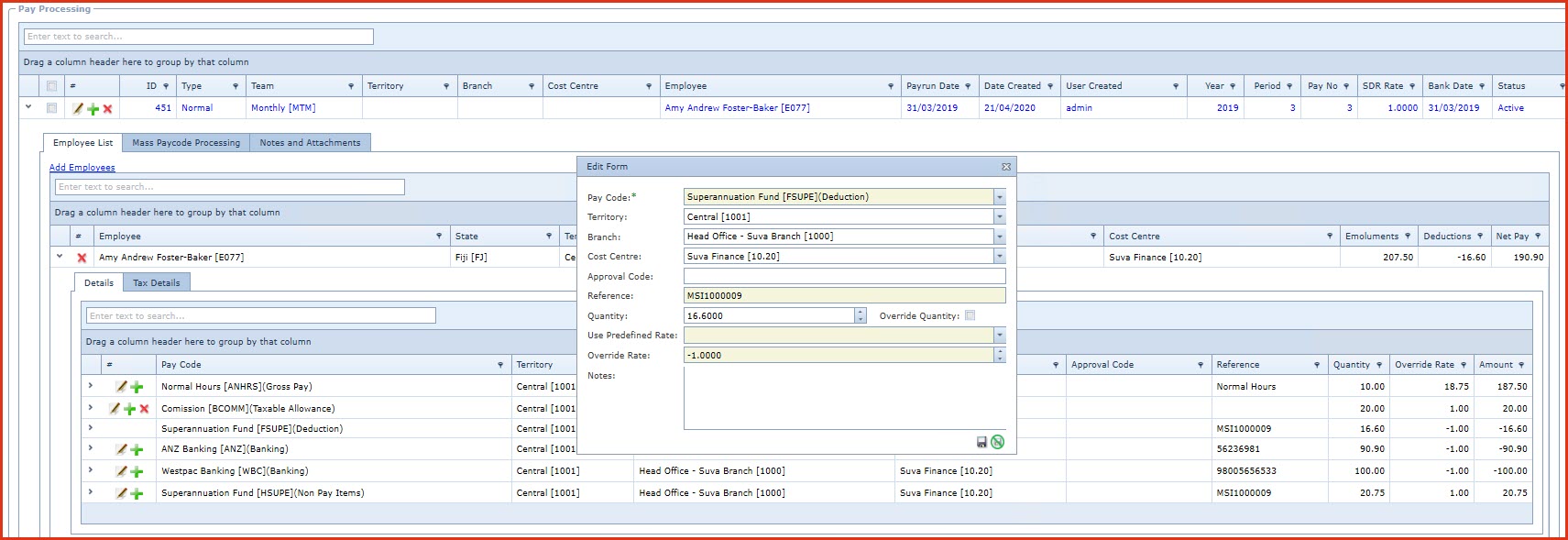

Expand the employee record.

This will

load the pay details for the

selected

employee. Users can edit the "Quantity". Refer

to Figure 2.

-

Override Quantity:

-

Override Quantity should be "Ticked" in

scenarios

where users need to manually change

the

standard pay quantity. For example, a change

in superannuation amount.

-

This record will

be

highlighted in red to indicate values have

been manually changed.

-

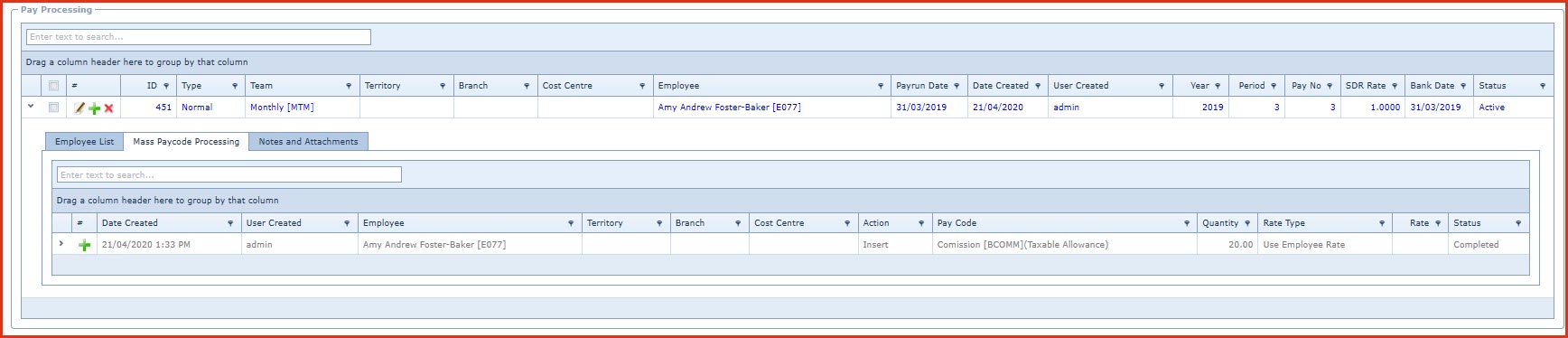

Mass Paycode

Processing - This is used to "Add ", "Delete" or "Modify" pay components for multiple employees

with the same rate or quantity. For example, paying $100.00 bonus for all staff. Refer

to Figure 3.

-

Click on the "Green Plus" sign on the "Mass Paycode Processing" tab. This will open

the "Edit Form"

-

Enter below details

-

Employee -

Users can select to modify the pay for a

specific

"Employee".

-

This

list will only load employees who are in

the

pay.

-

Territory - Users can select to

create the pay for a specific "Territory". This will create the pay for

all employees in the selected

"Territory".

-

Branch - Users can select to create

the pay for a specific "Branch". This will create the pay for all

employees in the selected

"Branch".

-

Cost Centre - Users can select to

create the pay for a specific "Cost Centre". This will create the pay

for all employees in the selected

"Cost Centre".

-

Action - Select the option for mass pay

processing:

-

Insert - Insert will add the

selected paycode into the

pay.

-

Update - Update will modify the value of the

selected pay

code.

-

Delete - Delete will remove the

selected paycode from the

pay.

-

Paycode - Select the paycode that needs to be

amended.

-

Quantity:

-

Enter the quantity as 1 if a fixed amount is

to be

paid.

-

Update the quantity with hours to pay if the

employee rate is used for

payments.

-

Rate Type - Select the

rate type:

-

Use Employee Rate - This will use the

effective rate from the employee profile to calculate the

pay value.

-

Use This Rate - Users can define a fixed

amount

to pay.

-

Rate - Enter the rate for payment when rate

type is "Use This

Rate".

-

Reason - This is an open text field. Users can

enter referential

details.

-

-

The notes is updated with

error log during pay

processing.

Commands

Commands are used to

define the payroll processing

workflow.

Workflow "Pay

Processing Approval" is used for

alerts, approving or rejecting

pay.

-

Verify

-

Security access: HR332-3 - Can "Verify Pay" in menu

"Payroll Processing -> Pay Processing"

-

Verify pay does the

following:

-

Recomputes the pay values such as tax and

super

-

Validates

Employee profile rate is different from pay

rate.

-

Validates

Deduction is more than deduction

threshold

-

Submit - Submit the

pay for review and

approval.

-

Approve - Approve the pay. Once approved no

amendments are allowed. The approver

can still reject the

pay.

-

Reject - Reject

the pay. Pay can be

amended and resbumitted for

approval.

-

Close - Click on the "Close Pay" button to update pay.

This

was update payroll reports and

journals with the pay

values.

Plugin

Plugin

"PAY001"

-

Use this plugin to send email to the approvers with pay

reports. The content of the email can be configured in menu: "Document

Template

-> Pay Processing Approval

Alert"

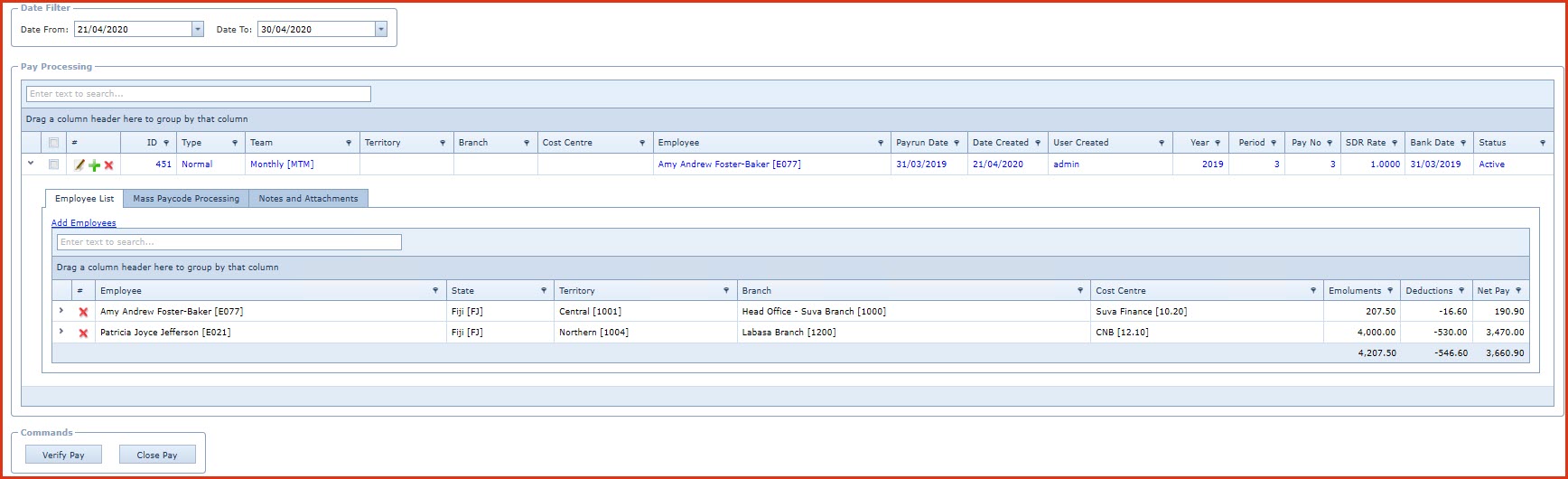

Figure 1: Pay Create

Figure 2: Edit Pay

Figure 3: Mass Paycode Processing

Link Technologies - LinkSOFT Documentation

Link Technologies - LinkSOFT Documentation  Link Technologies - LinkSOFT Documentation

Link Technologies - LinkSOFT Documentation