Link Technologies - LinkSOFT Documentation

Link Technologies - LinkSOFT Documentation  Link Technologies - LinkSOFT Documentation

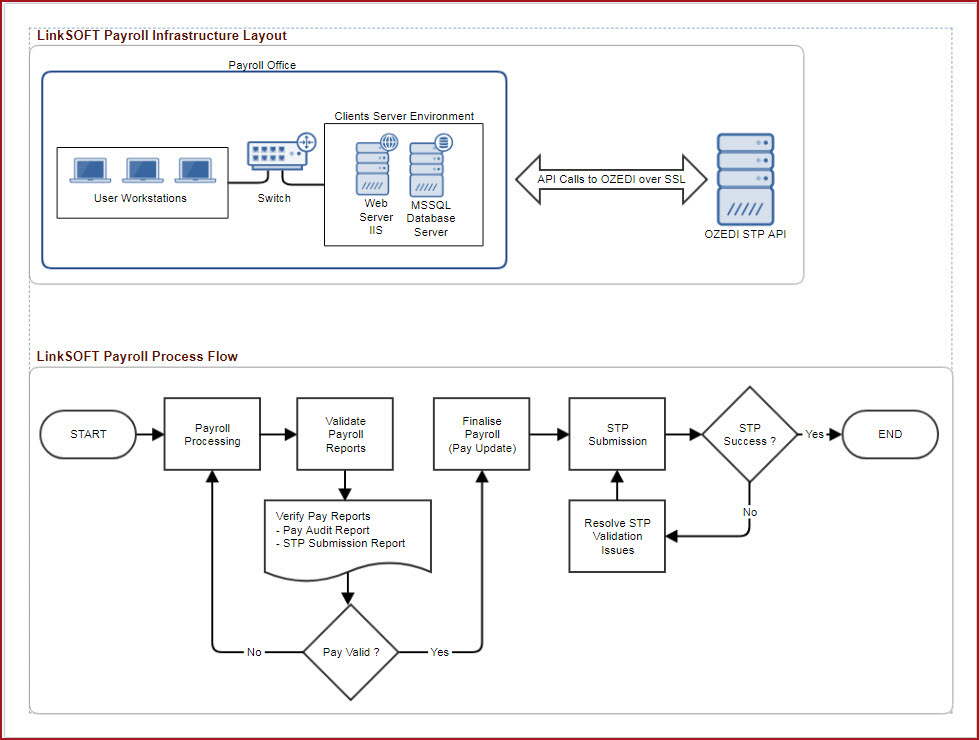

Link Technologies - LinkSOFT Documentation Single Touch Payroll (STP) is a requirement by Australian Tax Office (ATO). Electronic submission of year to date figures for employees is required from the 1st of July 2018. The electronic submission is required whenever an employee is paid. Refer to Figure 1 for LinkSoft Payroll Process Flow.

To meet these requirements, LinkSOFT produces a submission at the close of every pay. This includes backpay, special pay runs, etc.

Pre-requisites

The following pre-requisites are required:

Steps

Once the pre-requisites have been completed, you will be provided with a "Client ID" by Link Technologies.

Listed below are the business rules for STP:

Notes

1. Below are the status received from ATO:

QUEUED – successfully uploaded to

Ozedi

PUSHED – successfully

submitted to the ATO

RESPONDED – a

response has been retrieved from the ATO

NO

RESPONSE AVAILABLE – the ATO has not generated a response for 72

hours

2. Below are the status implemented by LinkPAY:

COMPLETED - This status is used to denote

that a submission has been successful. This implies ATO has accepted the

submission.

DATA VALIDATION FAILED - This message indicates that the payroll data content is

invalid. Invalid data can consist of country code, tax file number, state, etc.

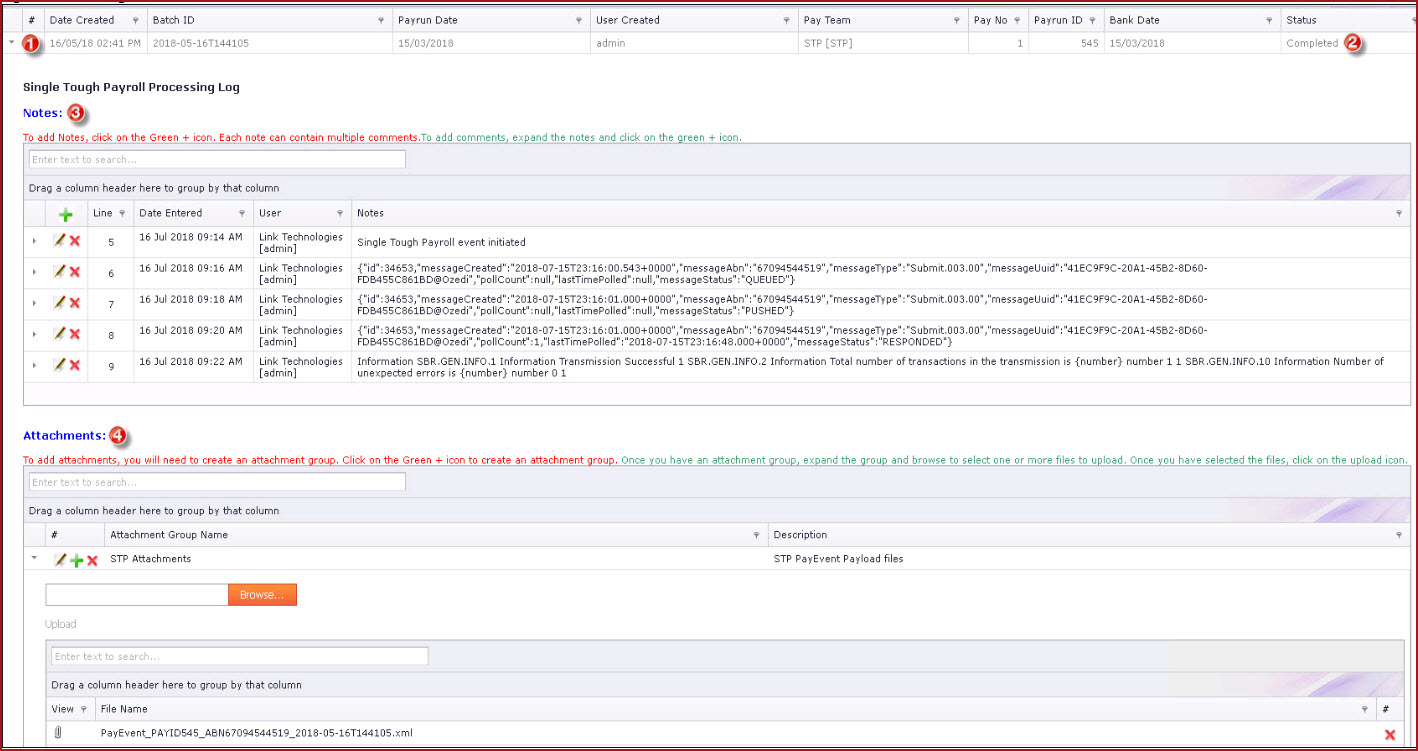

The error message displayed in the notes section (Figure 1 (3)) will explain the

details of validation failure. The error message is a JSON format which can be

reformatted using an online formatter available at this

link. Please contact Link

Technologies support if you need assistance with reading the error

messages.

FAILED -

Failure in submission where the user has no control. This could be caused by

network access, firewalls or API availability. In this case, users are asked to

contact Link Technologies support.

Figure

1: STP

Processes.

Figure 2: ATO

Single Touch Submission