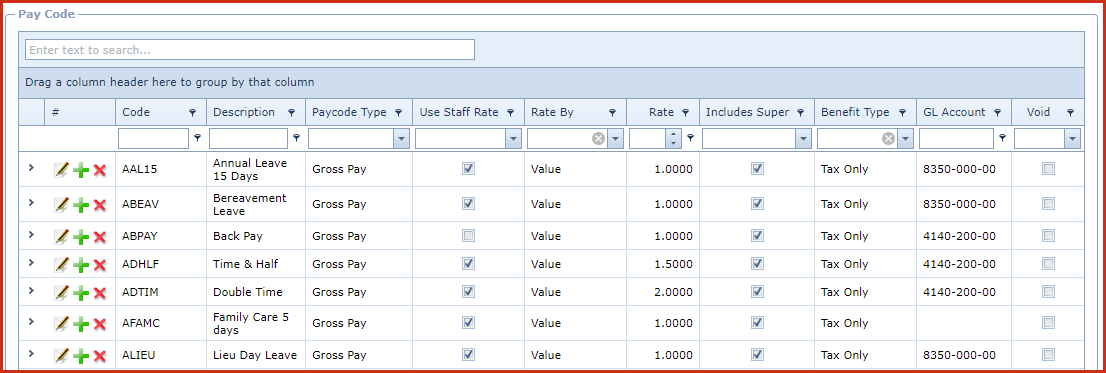

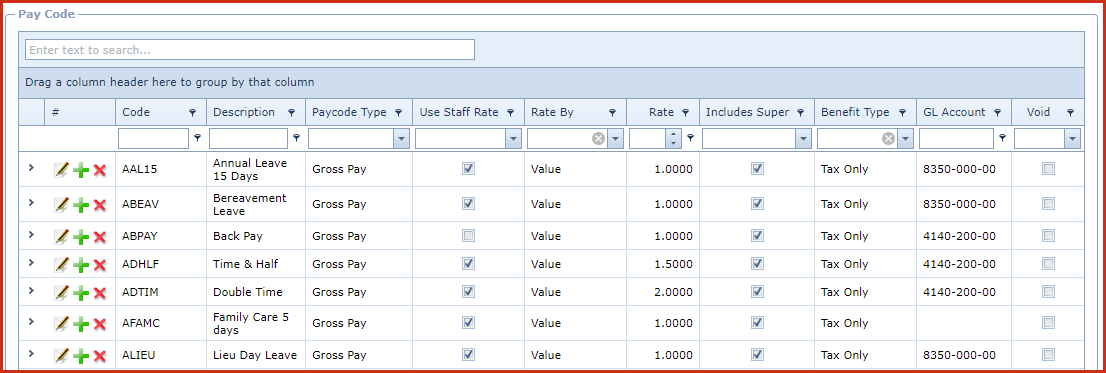

Pay Codes are used to create and maintain pay components

paid to an employee. For example, Normal Hours, Taxable and Non - Allowances,

Benefits and others.

Notes

- A paycode for a leave is automatically created when the leave code is

created.

Reports

- Paycode Listing

Pre-requisites

Enable the "Allow Add", "Allow Edit" and "Allow Delete" access under "

Role

Menu Access

" to

make changes.

Steps to create a Pay Code:

Click on "Green Plus Sign". This will open the edit

form.

Code - Enter a code which can be a set of

alphanumeric values to uniquely identify each pay code.

Description - Enter the detailed description of the

pay code.

Paycode Type

- Related data fields will load when the paycode type

is selected.

- Banking and Deduction

- Includes Banking - "Includes Banking" if ticked

will be included in the "Direct Credit" payments.

- Bank Code - Select the "Bank" from the list.

Bank is maintained under "Linkweb - Company Administration - Bank"

- Bank Account - Enter the "Bank Account" number

for the selected bank.

- GL Account Code - Enter the "General Ledger

Code" from the financial database that is used to integrate pay amounts

into the financial.

- Creditor Code - Enter the "Creditor Code" from

the financial database that is used to integrate pay amounts into the

financial.

- Commission Percent - Enter the percent that

should be used to calculate the commission.

- Commission GL Code - Enter the "Omission

General Ledger Code" from the financial database that is used to

integrate commission amounts into the financial.

- Group GL Transactions - "Group GL Transaction" if ticked will group

pay amounts by the "General Ledger Code".

- Benefit, Gross Pay, Tax Adjustment and Taxable

Allowance

- Includes Super - "Includes Super" if ticked

will be calculate the superannuation when the paycode is used.

- Calculate Leave - "Calculate Leave" if ticked

will be use the hours of the pay code for calculation of leave accrual.

This is applicable for proportional leave accrual method.

- Benefit Type

- Cash - Cash benefits paid to the employee.

- Tax Only - Fringe benefits.

- Tax Scale Code - Select the tax code used to

calculate the tax payable for a benefit.

- Benefit is Taxable - Indicate if the tax is

calculated for the benefit.

- GL Account Code - Enter the "General Ledger

Code" that is used to integrate pay amounts into a financial system.

- Creditor Code -Enter the "Creditor Code" from

the financial database that is used to integrate pay amounts into the

financial.

- Commission Percent - Enter the percent that

should be used to calculate the commission.

- Commission GL Code - Enter the "Omission

General Ledger Code" from the financial database that is used to

integrate commission amounts into the financial.

- Group GL Transactions - "Group GL Transaction" if ticked will group

pay amounts by the "General Ledger Code".

- Non Pay Items and Non-Taxable Allowance

- Includes Super

- GL Account Code - Enter the "General Ledger

Code" that is used to integrate pay amounts into a financial system.

- Creditor Code - Enter the "Creditor Code" from

the financial database that is used to integrate pay amounts into the

financial

- Commission Percent - Enter the percent that

should be used to calculate the commission.

- Commission GL Code - Enter the "Omission

General Ledger Code" from the financial database that is used to

integrate commission amounts into the financial.

- Group GL Transactions - "Group GL Transaction" if ticked will group

pay amounts by the "General Ledger Code".

Classification - Classification is used to categorize

pay codes. Classification is used to classify and compute tax for tax

submissions. Classificatory are maintained under "Linkweb - Company

Administration - Dropdowns - Pay Classification".

Use Staff Rate - "Use Staff Rate"if ticked with use

the pay rate of the employee for payouts. This will normally be used for

allowances.

Rate By - Users can select whether to calculate rate

by value or percentage.

Rate - Enter the rate that should be used to make

payments. This is dependent on

the "Rate By" settings.

Is Tax Paycode - Paycodes that have "Is Tax Paycode"

enabled will be used in the calculation of the tax. By default the following

Paycodes have this enabled:

- FPAYE - Pay As You Earn

- FPAYEECAL - Environment and Climate Adaptation Levy

- FPAYESRL - Social Responsibility Levy

- FPAYEOTH - Other PAYE Tax

- HPAYE - Employer Fringe Benefit Tax

Notes - This is an open text field, users can enter

desired content.

Void - Void records will be "Disabled" and will not

appear in any lookups . Edit the record and "UN-tick" void to activate a

record

Save. Click on the "Floppy Icon".

Add Notes and Attachments

Figure 1: Pay Codes

Link Technologies - LinkSOFT Documentation

Link Technologies - LinkSOFT Documentation  Link Technologies - LinkSOFT Documentation

Link Technologies - LinkSOFT Documentation