Link Technologies - LinkSOFT Documentation

Link Technologies - LinkSOFT Documentation  Link Technologies - LinkSOFT Documentation

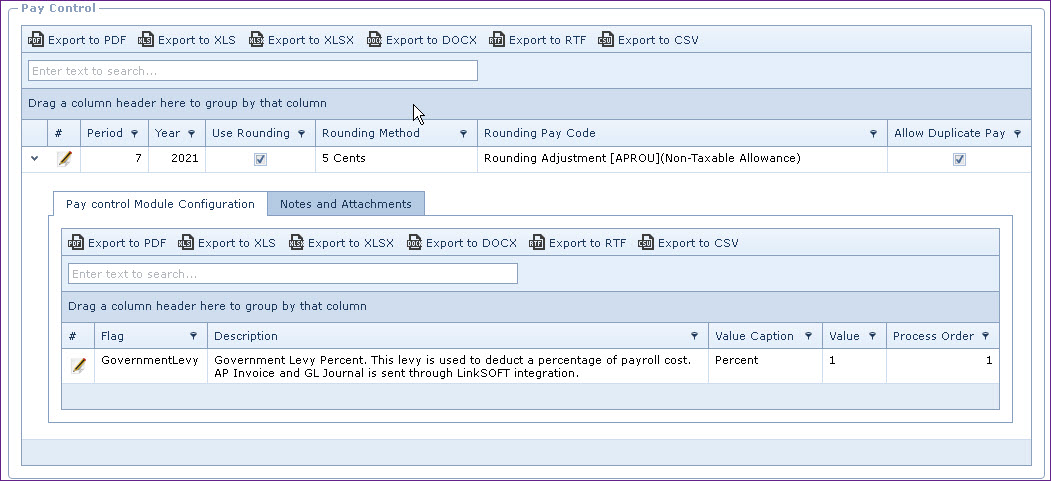

Link Technologies - LinkSOFT Documentation Pay Control is used to maintain current pay settings. The following are managed under pay control:

Active period is the current period in which pay and leave is processed.

The period start and end dates are matched with Pay Calendar . The period and year is automatically updated when a Pay Calendar record is closed.

Users will not be able to generate pays if the active period does not match the pay date.

Field Description

Period This is the current payroll month

Year

This is the current payroll

year

Pay Rounding allows users to configure the cash rounding depending on the legislative law of the country.

Rounding is used for employees who are paid cash where employee's pay is rounded down or up to the nearest cents or dollar.

| Field | Description |

| Use Rounding | Specify whether Pay Rounding is applicable |

| Rounding Method | Choose the "Rounding Method" to use. The options are "5 Cents", "50 Cents" or "1 Dollar"Employee's that are paid cash will have their net pay adjusted to the nearest "Rounding Method" selected |

| Rounding Paycode | Specify the rounding paycode to use. By default this is set to "APROU" |

Indicates if the system can process duplicate pay within the same pay period.

| Field | Description |

| Allow Duplicate Pay |

If Allow Duplicate Pay check box is active then the Organisation can accommodate more than one pay process for the same date. This is usually done to make adjustments. If Allow Duplicate Pay check box is not active then the organization can not process pay twice for the same pay date. This is a security functionality which the organisation has option of activating to prevent fraud by employees who are processing payroll. |

| Field | Description |

| Pay Control Configuration -> GovernmentLevy |

Government Levy Percent. This levy is used to

deduct a percentage of payroll cost. Paycode "HGOLV" is used in AP Invoice and GL Journal |

Figure 1: Pay Control