Link Technologies - LinkSOFT Documentation

Link Technologies - LinkSOFT Documentation  Link Technologies - LinkSOFT Documentation

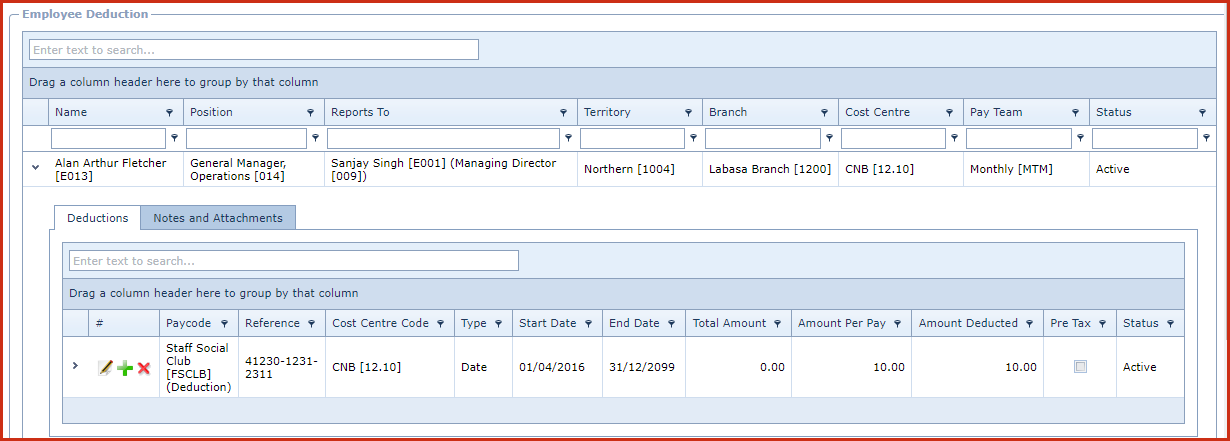

Link Technologies - LinkSOFT Documentation Deductions is used to setup paycodes that will be deducted

in each pay. There are controls in place to specify when to stop the deduction.

The following functions are available: To import deductions in pay, setup the

configuration

:

"Payroll -> Payrun Type -> Include "Deduction" entries when creating a

pay." Deductions can be setup in two ways: This flag controls if the deduction is before tax or after tax

calculations. Figure 1: Employee Deduction

1. Configuration to Import Deduction in pay

2. Setup Deduction

Field

Description

Paycode List of

Paycodes

filtered by "Paycode Types: Deduction"

Reference

Reference code

to tag with the deduction.

Cost Centre

Cost Centre used when processing pay.

Based On

Start Date

When using "Date" option. Date

entered here is when the deduction is effective from.

End Date When using "Date" option. Date entered

here is the end date. Once the "End Date" has reached, the deduction

status will be closed. Total Amount

When using "Value" option. Amount entered

here is the ceiling amount. Once this amount has been deducted, the

deduction status will be closed.

Amount Per Pay This is the dollar value of the benefit

deducted in each pay

Amount Deducted

This is a cumulative sum of the amount of

deduction that has been deducted.

Pre Tax

Status

The following statuses are available:

Notes This is

an open text field, users can enter desired content.